Bitcoin’s price may be hovering close to a five-month low, but U.S. President Donald Trump’s tariffs have hit the country’s largest tech companies harder.

Since Nov. 5, the largest cryptocurrency by market value has strengthened against the “Magnificent Seven,” a group of Nasdaq firms including top tech names like Apple, Nvidia, and Tesla.

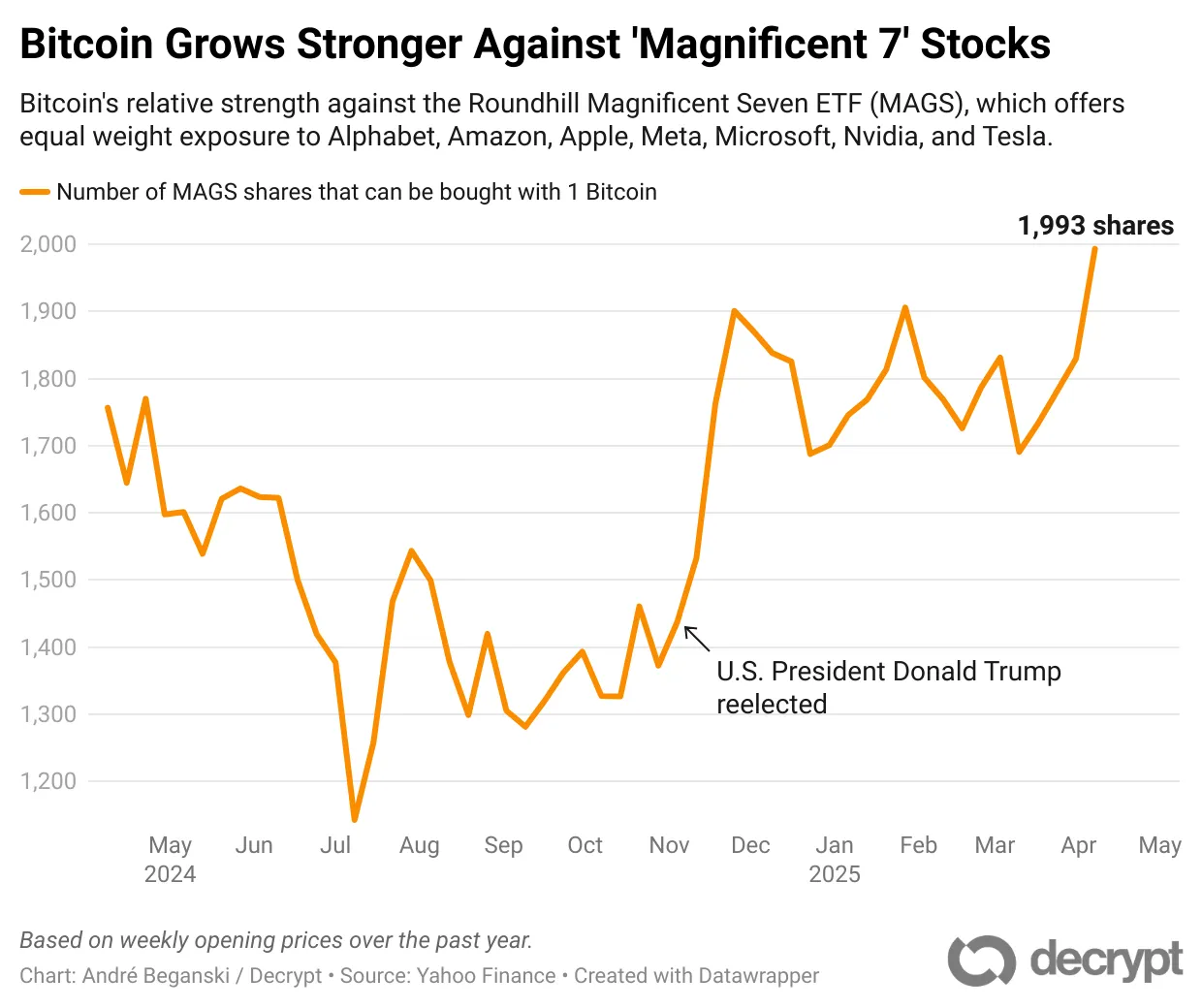

On Monday, one Bitcoin was worth around 1,993 shares of the Roundhill Magnificent Seven ETF (MAGS), which offers equal weight exposure to the group of tech firms. A year ago, one Bitcoin could’ve bought 1,756 of the exchange-traded fund’s shares, when it was worth $69,000.

On Friday, Matthew Sigel, head of digital assets research at asset manager VanEck, said the ratio had reached an all-time high on X, formerly known as Twitter.

“[I’ve] been telling clients for years to use Bitcoin to hedge FAANG exposure,” he added, referring to a popular acronym for mega-cap tech stocks Meta (formerly Facebook), Amazon, Apple, Netflix and Google.

Bitcoin’s relative strength against Magnificent Seven stocks was at its highest level within the past year on Monday, rising 13.5% over the course of that period. Despite Bitcoin recently trading like a tech stock, some market participants viewed it as a sign of divergence.

“In past market turmoil, Bitcoin has had a mixed track record of providing short-term protection,” Bitwise Senior Investment Strategist Juan Leon told Decrypt. “Is this the turning point when it starts to shine as a resilient short and long-term store of value?”

As the president has pushed forward with his trade war, U.S. stocks have weathered their worst stretch since the onset of the coronavirus pandemic. On Monday, the S&P 500 fell for a third straight day and has dropped 10% over the past week, per Yahoo Finance.

Bitcoin’s price fell as low as $74,600 on Monday, setting a new low for Trump’s second term, according to crypto data provider CoinGecko. While the S&P 500 has given up its post-election gains, Bitcoin is still changing hands above its Election Day price of $69,000 on Nov. 5.

“Compared with historical macroeconomic shocks or crypto market cycles, these are not record-setting drawdowns,” Thomas Perfumo, Kraken’s global economist, told Decrypt. “The asset class has weathered worse and, historically, emerged stronger each time.”

Edited by James Rubin

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.