Phong Le, CEO of Strategy, has unveiled a new financial model that reframes traditional corporate finance through the lens of Bitcoin. Titled “A New Financial Standard: KPIs for Bitcoin,” the framework introduces a Bitcoin Standard that redefines how companies approach valuation, capital deployment, and corporate governance.

According to Phong Le, the “BTC Standard” will transform key pillars of corporate finance: valuation and options, capital deployment and structure, and corporate governance.

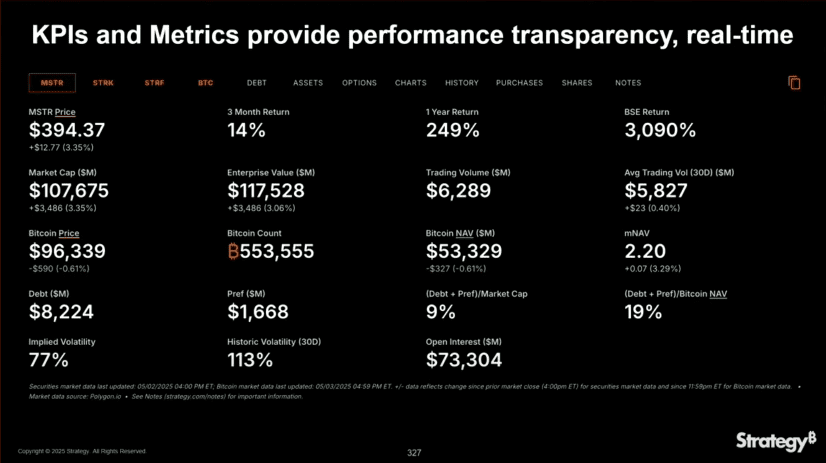

At the heart of this shift is a new framework built around Bitcoin-based Key Performance Indicators (BTC KPIs), created to offer companies performance transparency in real time. These include BTC Yield, BTC Gain, and BTC $ Gain. Valuation metrics include BTC $ Income, BTC $ Value, BTC $ Equity, BTC Torque, and BTC Multiple. Credit metrics include BTC Rating, BTC Risk, BTC Credit, and BTC Credit Hurdle.

Strategy updates its BTC KPIs every 15 seconds. This stands in stark contrast to the traditional model of reporting every 90 days, which Le says makes Strategy’s approach approximately 500,000x more transparent.

Recent BTC valuation data from Strategy includes a BTC Torque of 6.9x on $100 million of MSTR equity, with a 30% BTC ARR, $50 million in BTC $ Gain, $639 million in BTC $ Income, and $689 million in BTC $ Value.

For convertible debt, the company reported progressively higher BTC Torque figures:

- 8.9x with $64 million BTC $ Gain and $886 million BTC $ Value

- 10.4x with $80 million BTC $ Gain and $1.038 billion BTC $ Value

- 12.8x with $100 million BTC $ Gain and $1.279 billion BTC $ Value

These metrics reinforce the structural financial advantage Strategy sees in adopting the BTC Standard.

Le emphasized the need to consider both debt and equity when evaluating BTC Torque, stating, “To be able to issue debt, the folks who value that debt look at our debt-to-equity, look at our leverage, and so, to be able to issue more debt, we have to have more equity available. That is one reason why you can’t just look at BTC torque alone by itself.”

Le also announced that Strategy will publish and open-source a BTC Standard Model—similar to the Bitcoin model released in 2024—to help other companies adopt these KPIs. He referenced companies like Metaplanet and KULR as early adopters.

“The principles of corporate finance written in 1988 by Stuart Myers need to be updated,” Le said. “We need a book on the BTC standard… we’re writing the book as we go along.”

Those interested in watching the full Bitcoin For Corporations livestream can do so here:

News source: Strategy CEO Phong Le Reveals How MSTR Is Rewriting Corporate Finance In New Bitcoin Presentation

Read the full article and more directly from the source!

Enjoying our initiative? Support us with a BTC donation:

BTC Wallet: bc1q0faa2d4j9ezn29uuf7c57znsm5ueqwwfqw9gde