exchange-traded funds (ETFs) recorded $667.4 million in net inflows on May 19, the largest single-day total since May 2, signaling renewed institutional interest.

Nearly half of these inflows, $306 million, went into iShares Bitcoin Trust (IBIT), now at $45.9 billion in net inflows, according to data source Farside Investors.

The renewed demand follows bitcoin’s strong price performance, having traded above $100,000 for 11 consecutive days, which has helped restore market confidence.

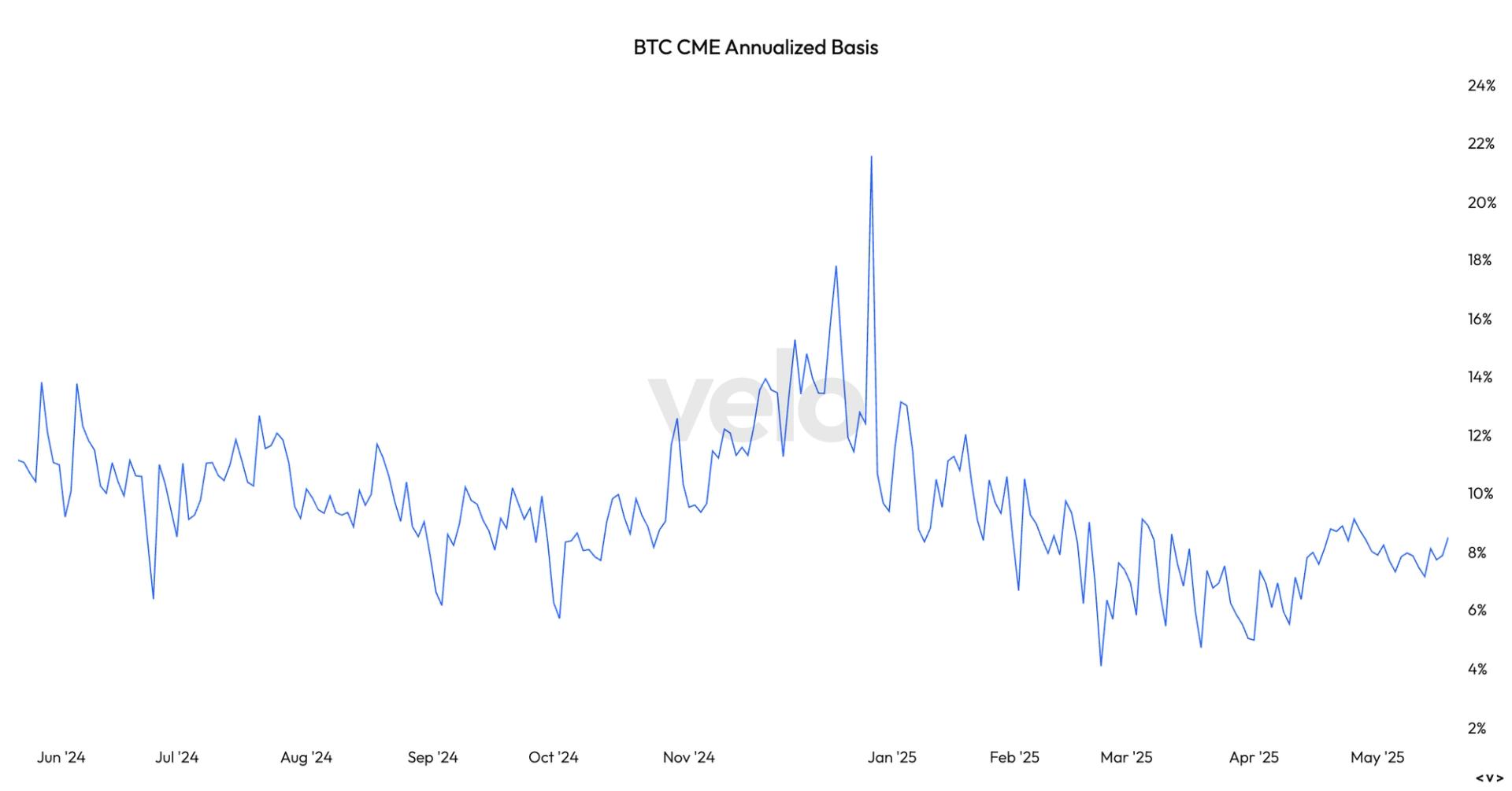

Additionally, the annualized basis trade, a strategy where investors go long on the spot ETF and simultaneously short bitcoin futures contracts on the CME, has become increasingly attractive, with yields approaching 9% almost double what was seen in April.

According to Velo data, this has sparked a modest uptick in basis trade activity as evidenced by an increase in trading activity in the CME futures.

On Monday, CME futures volumes hit $8.4 billion (roughly 80,000 BTC), the highest since April 23. Meanwhile, open interest stood at 158,000 BTC, up over 30,000 BTC contracts from April’s lows, further underscoring the growing appetite for leveraged and arbitrage strategies.

That said, both both futures volume and open interest remain well below the levels seen during bitcoin’s all-time high of $109,000 in January, indicating there’s still significant headroom for further growth.

The upswing in the basis suggests the growth may be already happening, bringing back players that left the market early this year when the basis dropped to under 5%.

Recent 13F filings revealed that the Wisconsin State Pension Board exited its ETF position in Q1, likely in response to a then-less favorable basis trade environment. However, given that 13F data lags by a quarter and the basis spread has since widened from 5% to nearly 10%, it is plausible that they have re-entered the market in Q2 to capitalize on the improved arbitrage opportunity.

News source: BTC ETF Inflows Surge as Basis Trade Nears 9%, Signaling Renewed Demand

Read the full article and more directly from the source!

Enjoying our initiative? Support us with a BTC donation:

BTC Wallet: bc1q0faa2d4j9ezn29uuf7c57znsm5ueqwwfqw9gde