Solana (SOL)

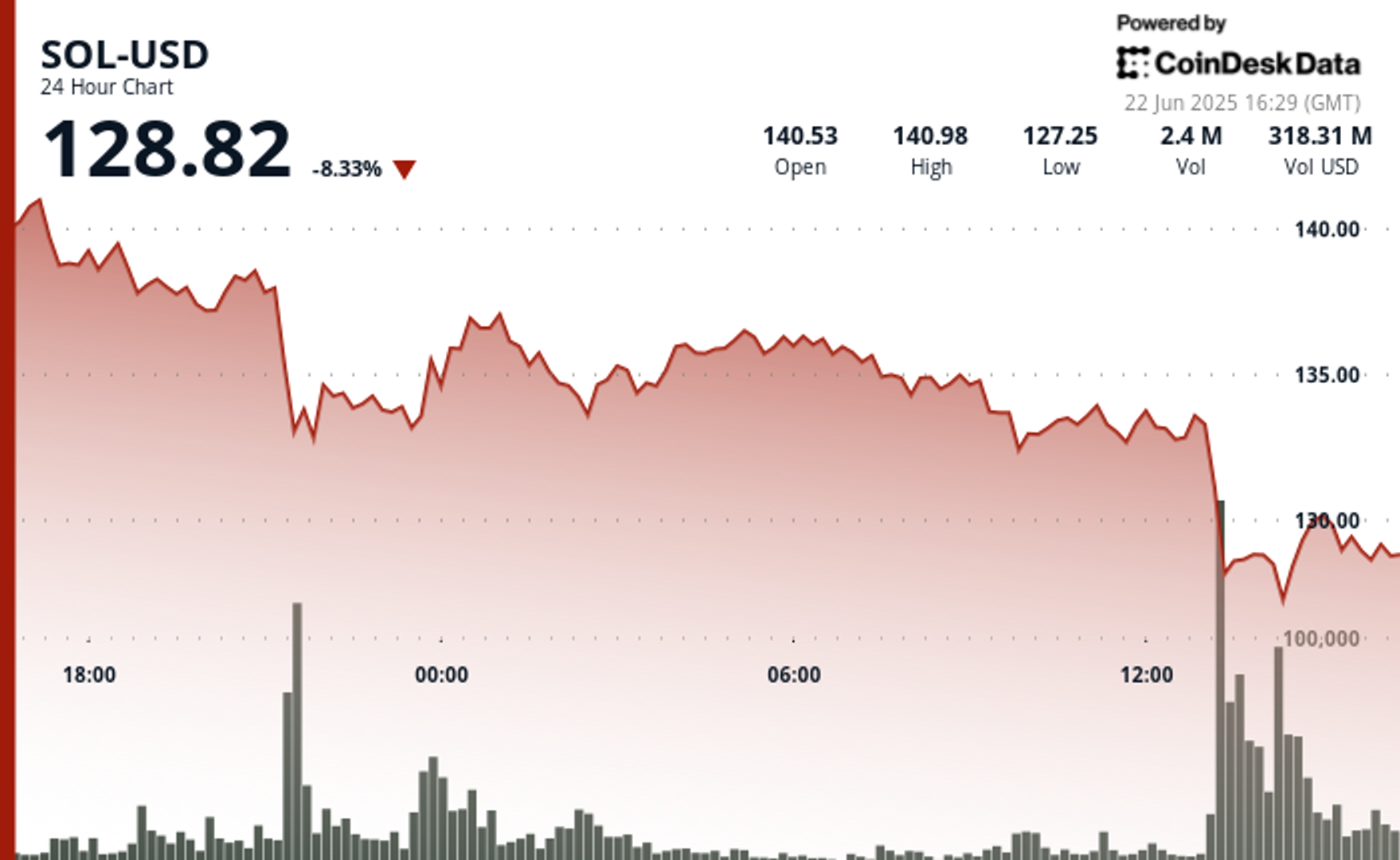

is trading at $128.82, down 8.33% in the past 24 hours, after a steep intraday correction linked to rising geopolitical tensions. The token dropped from $140.39 to $127.25, with the sharpest hourly decline occurring at 13:00, when sell pressure spiked and trading volume exceeded 4 million, according to CoinDesk Research’s technical analysis model.

The market reaction followed confirmed reports of U.S. military strikes targeting Iranian nuclear sites, triggering widespread risk aversion across crypto markets.

Some traders now worry that a closure of the Strait of Hormuz, even if temporary, could send oil prices soaring. That would likely stoke inflation, reduce the odds of near-term Fed rate cuts, and prolong the risk-off environment hurting crypto markets. A direct attack on the waterway could intensify the sell-off in altcoins, as bitcoin dominance historically rises during periods of geopolitical turmoil.

SOL’s decline also marked a break below key technical levels, including the 200-day simple moving average near $149.54. Throughout the session, SOL printed lower highs and struggled to sustain rebounds, pointing to weakening market structure. With elevated volume on red candles and technical indicators flashing bearish, traders are now watching the $120–$125 zone as a potential support area.

Technical Analysis Highlights

- SOL dropped 8.1% from $140.39 to $129.02 during the analysis period, forming an $11.37 decline.

- The session’s widest price range stretched from $141.14 to $126.85, a 10.2% intraday swing.

- The largest hourly drop occurred at 13:00, with price falling from $133.58 to $128.82 on 4.03M volume.

- A descending channel developed across the session, with lower highs and lower lows confirming bearish structure.

- Key resistance formed at $133.80, which capped multiple rebound attempts.

- Initial support emerged at $127.43, while a new intraday floor formed at $128.90.

- From 15:25 to 15:27, a volume spike pushed price below $129.30 during a continuation sell-off.

- Late-session movement showed SOL trading between $130.42 and $128.85 under consistent sell pressure.

- Several recovery attempts near $130.05 failed as volume increased on each rejection.

- Significant supply concentration appeared near $130.20, reinforcing short-term bearish momentum.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

News source: Solana (SOL) Drops 8% as Middle East Conflict Intensifies, Driving Crypto Sell-Off

Read the full article and more directly from the source!

Enjoying our initiative? Support us with a BTC donation:

BTC Wallet: bc1q0faa2d4j9ezn29uuf7c57znsm5ueqwwfqw9gde