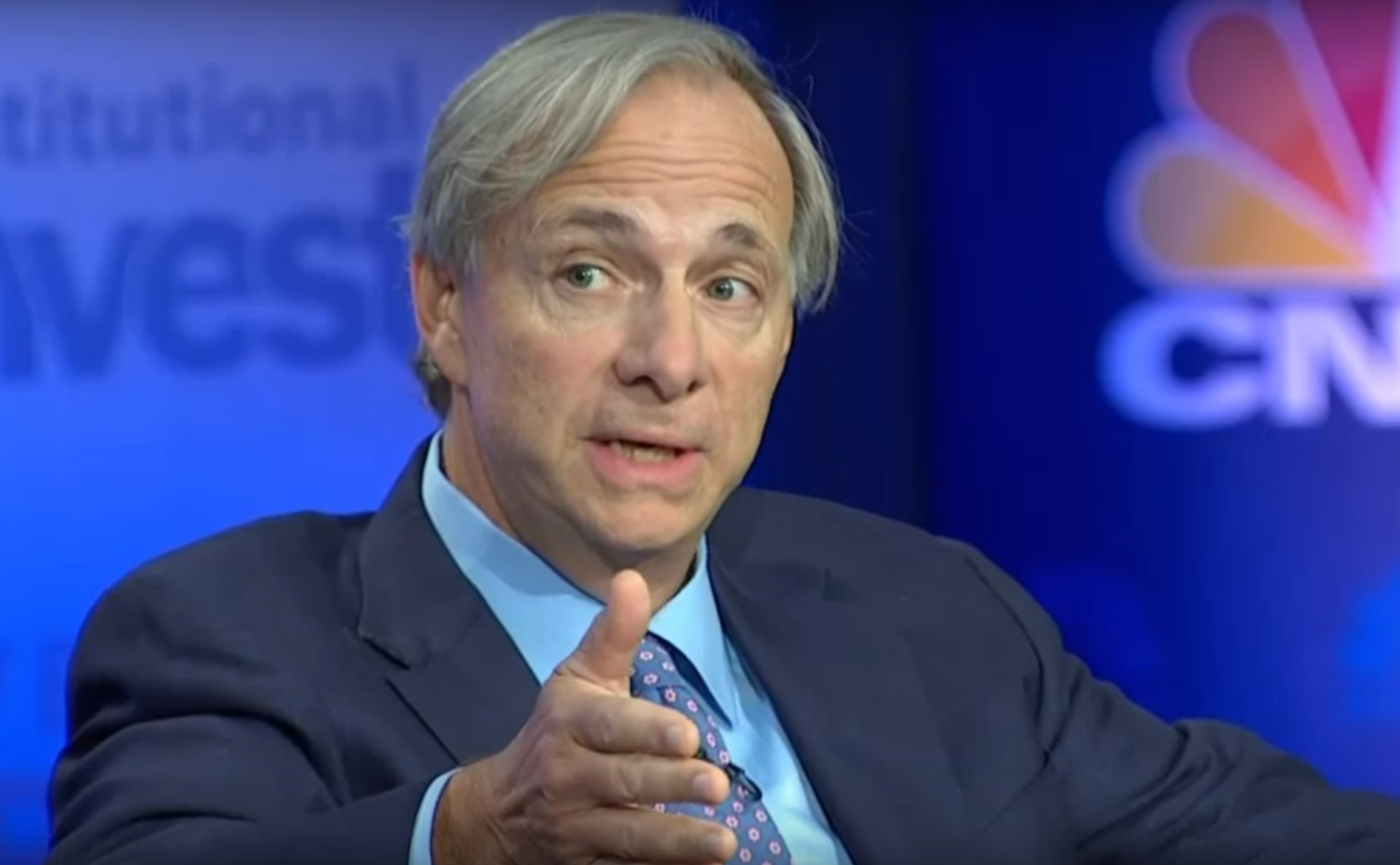

Ray Dalio is sounding the alarm — not just about a potential recession, but about a deeper, systemic breakdown of the global economic and political order in an interview with CNBC on Sunday. His concerns aren’t just about market volatility; they point to a broader structural fragility.

Interestingly, bitcoin (BTC) has been showing resilience amidst the chaos. The digital asset has broken a three-month downtrend and is approaching $85,000, signaling it may be stepping into a role as a potential alternative safe haven.

Mixed signals continue from the White House on tariffs, adding to the growing uncertainty weighing on global markets. As a result, markets continue to be extremely volatile especially over the past two weeks as Trump’s tariff policies take hold.

Dalio, the founder of investment giant Bridgewater, is particularly focused on the mounting U.S. debt and deficit. He argues that Congress must bring the federal deficit down to 3% of GDP, warning that the imbalance between debt supply and investor demand could cause serious dislocations, according to CNBC.

That’s already playing out in the bond market, where U.S. Treasury yields are climbing. The 10-year sits just under 4.5%, while the 30-year is hovering just below 5%. These elevated yields are rattling markets and could force the Federal Reserve to step in in order to calm markets.

Dalio also warns that tariff uncertainty is feeding into broader macro instability. The U.S. dollar, as measured by the DXY index, has now fallen below 100 for the first time in years — a potential sign of capital flight from the country. He is calling for a comprehensive trade deal with China and a currency adjustment to strengthen the yuan, aiming to stabilize a system that’s looking increasingly fragile, according to the report.

In a sobering comparison, Dalio likens today’s risks to those seen during the U.S. exit from the gold standard in 1971 and the global financial crisis in 2008, according to the report. Both were inflection points that reshaped the financial system.

Disclaimer: This article, or parts of it, was generated with assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

News source: Ray Dalio Sounds the Alarm on Global Systemic Risk, But Bitcoin Remains Resilient

Read the full article and more directly from the source!

Enjoying our initiative? Support us with a BTC donation:

BTC Wallet: bc1q0faa2d4j9ezn29uuf7c57znsm5ueqwwfqw9gde