Bitcoin (BTC)

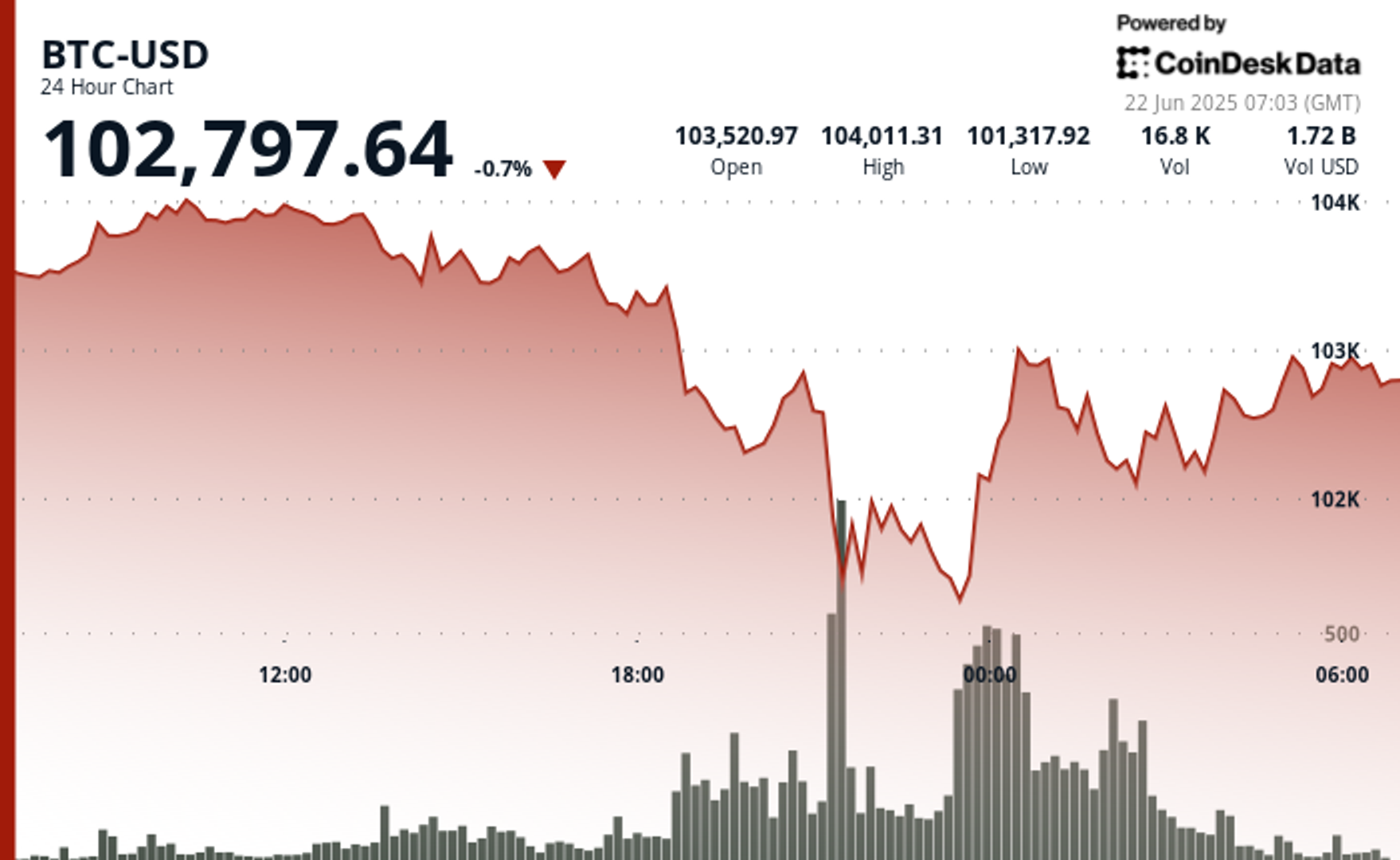

rallied above $102,000 after briefly falling below $101,000 in a volatile session marked by unusually heavy trading, according to CoinDesk Research’s technical analysis model.

Market participants reacted swiftly to the dip, which pushed BTC near the bottom of its month-long trading range.

The reversal gained momentum as volume accelerated, leading to a strong rebound. The move coincided with a sharply worded post from hedge fund manager James Lavish, who wrote on X: “If you are selling Bitcoin because of the possibility of the world going to war, you have absolutely no idea what you own.”

The $100K–$110K range has contained price movement for nearly a month. On-chain metrics suggest a balanced market with neither excessive profit-taking nor aggressive accumulation, while derivatives data indicates cautious sentiment with continued demand for downside protection.

Technical Analysis Highlights

- A midnight push lifted BTC above $102,800 with trading volume peaking at 17,906 BTC.

- Between 05:57 and 06:00, BTC climbed from $102,767 to $102,912, supported by volume spikes over 150 BTC per minute.

- Peak recovery-period volume hit 184.24 BTC, helping drive price toward $102,990.

- Minute-level consolidation around $102,680–$102,720 preceded the breakout.

- A higher support level began forming near $102,870 as volatility decreased.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

News source: If You’re Selling Bitcoin Over War Fears, You Don’t Get It, Says Hedge Fund Manager

Read the full article and more directly from the source!

Enjoying our initiative? Support us with a BTC donation:

BTC Wallet: bc1q0faa2d4j9ezn29uuf7c57znsm5ueqwwfqw9gde